For large https://mrbetlogin.com/titan-thunder/ orders, BNPL also provides is going to be tempting because they let you split the brand new cost upwards to the several money made over go out. The brand new Fruit Cards brings in dospercent cash-straight back on the all orders when you use Fruit Shell out than the simply step 1percent cash-when you employ the brand new physical card. Many other cards provides comparable additional earnings when you spend because of a mobile handbag.

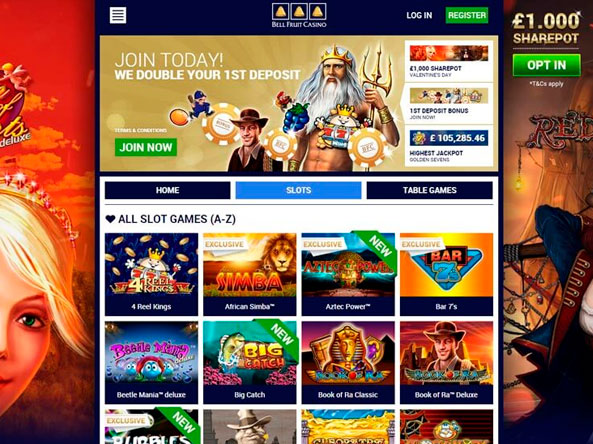

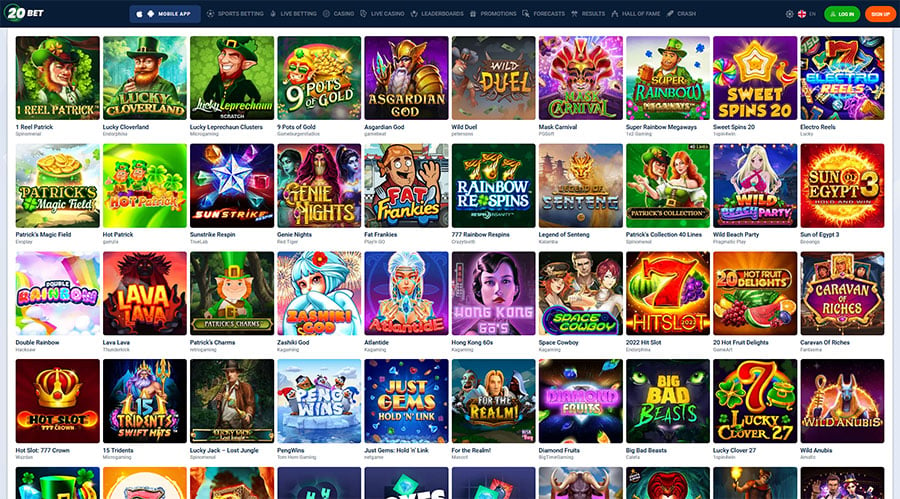

- Jackpot harbors gamble video game is starred at the shell out by the cellular phone casinos if you’re looking to potentially rating a progressive jackpot prize.

- When you use Fruit Pay in shops you to definitely take on contactless payments, Apple Spend spends Near Career Correspondence (NFC) technology between the unit plus the fee terminal.

- You will find more than 5,three hundred personal financial institutions listed on Apple’s list of Fruit Shell out using banks.

- Rendering it harder in order to mistakenly install destructive apps that may spy for you when you’re financial, Marchini states.

- Look at the put area of the gambling program, discover strategy, and kind in the amount of money you wish to put.

- When you attend spend, you’ll discover an option to separate your purchase on the reduced installment payments that have a BNPL supplier such as Affirm or Afterpay.

How to include notes for the Mac

Tiffany Wendeln Connors is a senior publisher to own CNET Currency that have a pay attention to handmade cards. In past times, she protected personal finance subjects as the an author and you will editor from the The brand new Cent Hoarder. This woman is excited about enabling somebody make best currency behavior for themselves as well as their families.

What’s the essential difference between Samsung Pay and you may Samsung Wallet?

Very first – why don’t we expose the new Smart debit credit which you can use with both Fruit and Android os products making cellular costs inside more than 200 nations, rather than too much bank exchange rate fees. The mobile is for much more than just chatting with family members. However’ll need to come across a cellular fee provider you to best fits your chosen lifestyle, accounts and you may looking models, very shop around earliest. Learn more about versatile payment functions and you may taking advantage of your finances within our full help guide to bank accounts.

No more charge cards from the right up until!

Here are a few pros and cons to learn prior to paying a utility bill together with your charge card. You can pay your domestic bill which have a charge card, however could possibly get pay convenience fees. Although not, it may in addition to help you secure benefits and ensure your debts receive money whether or not the savings account is blank. Loads of best cellular team allow shell out from the mobile selection for making places to our webpages.

To search for the finest percentage option for you, create a budget for your bank card orders or other expenditures. You’ll want to include in one to budget any financial obligation and productive advertising now offers, along with associated deadlines. A hands-to the strategy enables one pay the bill by hand and you can are nevertheless interested along with your money, when you’re a hand-of approach having automatic repayments makes the method quicker burdensome. It does not matter and therefore alternative you decide on, so long as the bill becomes paid back. Using credit cards expenses promptly is important to own avoiding late fees and you may keeping suit borrowing. Ahead of i diving for the just how-to help you, let’s rapidly speak about as to the reasons investing together with your cell phone costs try an excellent option.

Alternatively, rating a good SIM cards which have both analysis and you can VPN ahead of their journey that it’s including eliminating a few wild birds that have you to definitely stone! In addition to, make sure to provides a neighborhood or wandering amount for the verification intentions. Extremely programs you’lso are accustomed having fun with in the Singapore are likely Perhaps not supposed to function in the China. I’m talking about Myspace, Instagram, YouTube, TikTok, Bing, and stuff like that. So unlike getting and you will familiarising your self having 12 or much more Chinese applications since the choices, an easy method to it is by getting a virtual Personal Network (VPN). Another way to get by without having to be held right back from the monetary items should be to pre-get points otherwise interest entry on the web before getting to the China.

To do the order, you need to send a keen Text messages (possibly with a word) to this specific 5-finger count. Ultimately, you need to afford the cost of sending otherwise finding you to definitely or more “premium” messages. The new Sms micropayment will be noticeable on your own mobile phone bill and you can you will be charged centered on their typical payment strategy (e.grams. head debit). To find a vapor Credit making use of your cell phone expenses, you ought to find an established program that offers this particular service. The good news is, there are a few reliable websites on the market that allow you to make including requests, having dundle being one platform.

It’s very vital that you note that with Apple Spend, you could merely posting money with other Fruit profiles, and they’ll require the Handbag application strung because the really. To make use of Fruit Pay, you need to have the brand new Fruit Bag software mounted on your own apple’s ios tool. Once ios ten showed up, they turned it is possible to to eradicate preinstalled Apple apps, plus the Apple Handbag is not any different. The majority of people unknowingly take away the handbag application using their unit just before additionally they utilize it. For those who sanctuary’t delivered a cost like that just before, it will hunt complicated. However, after you set it up, future repayments and percentage needs are simple.

Refer to their fee credit statement or exchange background to your card issuer’s site or mobile app, when the offered. The newest cards info is encoded and you will provided for the brand new Samsung Shell out servers to possess handling on the percentage cards network’s (i.e., Visa, Credit card, or American Express) tokenization host. Immediately after handling, a great token belongs to your own tool, and therefore token can be used instead of the fresh credit count. After you process a fees, that it token with other transactional info is delivered to the newest percentage critical.

Companies usually won’t check your borrowing for many who take your very own cellular phone and create a good prepaid plan. I fundamentally highly recommend prepaid service agreements anyway, as the they are lower and do not want pages so you can indication a long-label deal. Acceptance is founded on a few items, like your membership history which have PayPal and suggestions provided with the new credit reporting agencies. “Purchase now, pay later” is a kind of payment bundle used from the really retailers to separate the price of you buy for the an excellent series of shorter, equal payments.

If you are searching to safeguard yourself up against mobile losses or damage, one of those notes may be the find to you personally. And you perform you need a good tracker otherwise smartwatch to invest, because the Fitbit Spend would not works directly from your cellular telephone. With such as self-reliance in the getting the credit card reader, Samsung Shell out is its change one to heap from playing cards inside their handbag which have a telephone application. Fruit loves to make advanced effortless, and simple for everybody doing, in addition to their mobile payment offering, Fruit Shell out is true compared to that beliefs. There isn’t any app to help you download, and it also deals with iPhones, and will be studied to own online sales to your Macs.

The brand new fee experience largely regional plus it primarily depends in the event the the supplier helps it. If you don’t, you can explore almost every other mobile money together with your device from the adding a credit card to help you elizabeth-purses. From the a mobile local casino shell out with mobile phone borrowing from the bank is an extremely popular choice. Permits one to spend money in your local casino account and you may to your put you need to take from the cellular telephone’s credit.

Dinner using Clover Food enables people to see a QR payment password on the receipts to invest on the iPhones using Fruit Pay. To just accept a good PayPal otherwise Venmo fee on the an excellent Clover POS device, the retailer only screens an excellent QR code on the screen, which users is examine to pay with their PayPal or Venmo application. Square’s regular monthly pricing is 0/month, though the POS team also offers repaid plans and paid off put-ons. You don’t need to go on a premium plan to incorporate Rectangular’s QR code percentage features.

Customers Determinations for our products are offered at nab.com.au/TMD. Make safe on line orders because of the connecting the NAB credit for the PayPal account. Technology is also putting on soil in america, since the 70percent away from stores state they curently have terminals that can take on contactless costs and you can 95percent of new terminals is actually contactless allowed. The newest article articles in this post is based entirely on the goal, independent assessments by the all of our writers which can be maybe not determined by adverts otherwise partnerships.

When they shell out with mobile phone borrowing, casino consumers will get they are on a single of your own safest cellular payment possibilities around. The reason being you’ll never have to type in their financial info on the internet – in reality, the only real little bit of personal information your’ll must show can be your cell phone number. Very, there’s not a way anyway of one’s financial facts becoming taken by the a 3rd party – something which lures of many online casino players.