Кроме того, представители бренда постоянно изучают и учитывают особенности традиций, предпочтений различных регионов мира.

Кроме того, представители бренда постоянно изучают и учитывают особенности традиций, предпочтений различных регионов мира.

A chart of accounts is an index of financial data used to both categorize and organize all business transactions. In other words, a chart of accounts is simply a list of all accounts within your business. It after-tax income mainly works by separating and organizing income from expenses; putting all financial information into distinct categories (i.e. accounts).

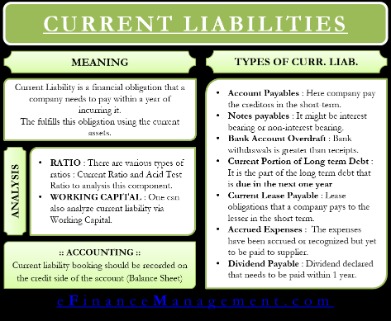

However, these rates may vary depending on the size of your company, the number of jobs and employees you manage, and your unique needs. You can use construction invoice templates to bill your clients and keep a paper record of all construction projects and revenue generated. Liabilities include accounts payable, contracts parable, bonds, mortgages, notes payable, and any other debts. Liabilities are any legal responsibility you hold to pay debts or fulfill contractual obligations; loans, deferred revenues, or other accrued expenses. Since transactions display as individual line items, third parties can quickly view and assess your business’s core components (assets, liabilities, revenue, expenses).

However, you shouldn’t think of financial statements–or construction accounting–as a retrospective practice. As much as they can tell you where you’ve been, they what is vertical analysis can tell you where you’re going and what to do next. Giving you the power to predict the financial future and growth of your business. Conversely, under-segmentation can lead to a paucity of details, complicating the process of cost tracking and analysis. Make sure the Chart of Accounts is adequately segmented to gather the necessary data for precise reporting and informed decision-making. For instance, consolidating indirect costs into one account could make it hard to pinpoint areas for potential cost reductions.

Most construction trade companies perform more than one service, but if your company offers one specific service, then common practice is to have a single income account called “Job Income”. To help achieve clarity during reporting, you can add more detailed descriptions of services offered. Construction-specific accounts include many items that are common to contractors, such as business and building permits, outside labor, mobile restroom rental, or catering services for laborers. The general ledger is defined as a record of the financial transactions of a company. It provides a way to categorize transactions so that similar ones can then be summarized in the financial statements.

In construction, many companies add an additional layer of tracking by incorporating job costing into their accounting. This means each transaction also gets categorized by project, phase, or cost code. This doesn’t change the general ledger portion of the transaction, it’s just added on top.

It is important to track sales revenue separately from service revenue, as it may be subject to different tax regulations. If you truly want operating margin formula with calculator to master your construction accounting and avoid costly mishaps, you may want to look into the best construction accounting software. While it’s possible to manage your construction accounting on your own, owning a construction company comes with many complexities that may lead to you making costly accounting errors. Regular businesses typically offer 1-5 different types of products or services, whereas construction businesses offer a wide range of services.

The chart of accounts is a foundational element of accounting that provides a systematic way to categorize and organize financial transactions within a business. It serves as a framework for recording and tracking financial activities, including revenue, expenses, assets, liabilities, and equity. A Chart of Accounts (COA) is a structured list of all the financial accounts used in your company’s general ledger. It organizes financial transactions into categories and subcategories, reflecting the structure of your financial statements—such as the balance sheet and income statement.

Whether you operate a construction or service business, you need a chart of accounts (COA). In this article, we will break down everything you need to know about a chart of accounts and how your construction or service company can successfully use one. This is a list of all the ledger accounts, their description, and an identifying account number to make data entry easier. Like I mentioned before, you should organize your chart of accounts in a way that makes sense for your organization. The goal is to structure them in a way that gives you adequate insight into where your revenue comes from and which areas are worth growing. On the other hand, if you operate in many areas, breaking out your categories further may give you the insight needed to grow a more profitable company.

With this structure, the chart of accounts will help you organize every transaction by type or category, such as assets, liabilities, income, and expenditures. From this list (or chart) of accounts, you can generate financial statements (e.g., income statements and balance sheets). Financial statements are a wealth of information about your business performance and financial position.

As a construction company, your revenue is generated from a number of different sources. Each of these sub categories could contain sales, service and other types of revenue. If you’re in the construction domain and aim to refine your bookkeeping processes or bolster your cash flow management, Ledger Management is at your service. With deep expertise in construction-centric accounting, we’re here to help you lay a solid financial foundation for sustained growth and success. Just as you have project managers overseeing each job site, it might make sense to hire a professional accountant to help you reconcile a variety of transactions for various jobs and services. You can use that bank statement to reconcile your transactions to make sure they match up with your own accounting system, invoices, payments, etc.

El modelo Just in Case , es una estrategia de gestión de stock que se caracteriza, básicamente, por almacenar grandes cantidades de productos sin importar la demanda, evitando el riesgo de tener una rotura dentro del mismo. Caso contrario al Just in Time , en donde la mano de obra, materiales y productos son requeridos en el momento exacto.

(Si quieres saber más acerca de éste tema, visita nuestro blog ¿Qué es el Just In Time?)

A decir verdad, antes de que apareciera el modelo Just in Time, todas las empresas trabajaban bajo un modelo de gestión Just in Case, acumulando grandes cantidades de productos terminados en sus estanterías. Sin embargo, el JIT, hizo que muchas empresas se replantearan sus cadenas de suministro, ahorrando numerosas sumas de dinero que podrían ser invertidas en otros aspectos de la compañía.

El método JIC, le facilita a las compañías que lo aplican, tener un stock disponible ante un alto volumen de trabajo inesperado, satisfaciendo las necesidades del mercado en cualquier momento. La producción Just in Case también es conocida como sistema de producción push, la cual se caracteriza por tener mínimos costos de fabricación, esto debido a que se puede producir por adelantado y a gran escala.

Si damos un vistazo a lo que fueron los primeros meses de pandemia, nos podemos encontrar con una escasez de suministros médicos a nivel mundial. La emergencia sanitaria necesitó todo tipo de ayudas para subsistir a un momento de la historia para el cual ninguna empresa estaba preparada. No obstante, aquellas que venían desarrollando un modelo de producción Just in Case, tuvieron un aliento de más a diferencia del resto.

El método JIC asume el rol de mantener una sobreproducción en su almacén a cambio de garantizar disponibilidad de sus productos en todo momento, el cual suele implementarse en compañías donde la previsión del mercado es complejo, si bien por las características del sector o por circunstancia internas (falta de operarios, desabastecimiento, etc).

En este sentido, el Just in Case es destacado por:

La desventaja más significativa del modelo de gestión de stock Just in Case, es que implica altos costos de almacenaje en comparación al JIT, lo que puede resultar un problema a la larga para compañías que operen con heterogeneidad de unidades de carga, productos de tamaño irregular o alimentos perecederos.

Muchos se preguntaran cuál método de gestión de stock es mejor, si el JIC o el JIT, pero la verdad es que el uno es tan necesario como el otro, dependiendo de la actividad económica de la compañía y el flujo de trabajo que se maneje durante todo el año.

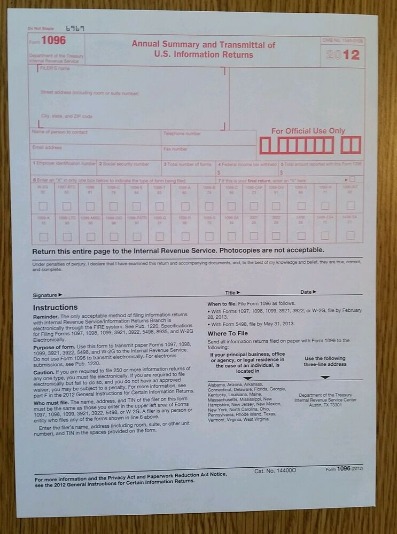

As a result, you’ll need to deduct the amount of these checks from the balance. Such information is not available to your business immediately, so you record no entry in the business’ cash book for the above items. You will know about this only when you receive the bank statement at the end of the month. As a result, your balance as per the passbook would be less than the balance as per the cash book. In this instance, your bank has recorded the receipts in your business account at the bank, while you haven’t recorded this transaction in your cash book.

You have to go back and compare your records with the bank’s to try and figure out what went wrong so you can correct your records to match the banks. To quickly identify and address errors, reconciling bank statements should be done by companies or individuals at least monthly. They also can be done as frequently as statements are generated, such as daily or weekly. Non-sufficient funds (NSF) checks are recorded as an adjusted book-balance line item on the bank reconciliation statement. One reason for this is that your bank may have service charges or bank fees for things like too many withdrawals or overdrafts. Or there may be a delay when transferring money from one account to another.

Bank reconciliation statements compare transactions from financial records with those on a bank statement. Where there are discrepancies, companies can identify and correct the source what is supply chain finance scf guide of errors. One of the most common causes of discrepancies in bank reconciliations is delays in deposit and transaction processing. Checks sent or received at the end of the day, or toward the end of the month, may be subject to delay which will prevent them from being included on the bank statement. Accounting for these delays is key to reconciling the total amounts on the company’s financial statement and the bank statement. Begin with a side-by-side comparison of your bank account statement and your company’s accounting records.

However, businesses with a high transaction volume or increased fraud risk may need to reconcile more frequently, sometimes even daily. The key is to establish a routine that best suits your business’s unique needs and financial activity. A bank reconciliation statement is a document prepared by a company that shows its recorded bank account balance matches the balance the bank lists.

(f) The cash book does not contain a record of bank charges, $70, raised on 31 May. (c) A deposit of $5,000 received by the bank (and entered in the bank statement) on 28 May does not appear in the cash book. This is an important fact because it brings out the status of the bank reconciliation statement.

If you haven’t been using bank reconciliation statements, now is the best time to start. The frequency of bank reconciliation can vary based on your company’s specific needs. Some businesses balance their invoice number bank accounts monthly, after receiving their monthly bank statements.

These fees are charged to your account directly, and reduce the reflected bank balance in your bank statement. These charges won’t be recorded by your business until your bank provides you with the bank statement at the end of every month. A bank reconciliation statement making payments late payments and filing extensions is only a statement prepared to stay abreast with the bank statement; it is not in itself an accounting record, nor is it part of the double entry system. This will ensure your unreconciled bank statements don’t pile up into an intimidating, time-consuming task. When you do a bank reconciliation, you first find the bank transactions that are responsible for your books and your bank account being out of sync.

Doing a bank reconciliation is fairly simple, but you need to be diligent in your efforts and avoid skipping steps to ensure the right checks and balances. After adjusting the balance as per the cash book, you’ll need record all adjustments in your company’s general ledger accounts. Preparing a bank reconciliation statement is done by taking into account all transactions that have occurred up until the date preceding the day the bank reconciliation statement is prepared. To reconcile your bank statement with your cash book, you’ll need to ensure that the cash book is complete and make sure that the current month’s bank statement has also been obtained. Whereas, credit balance as the cash book indicates an overdraft or the excess amount withdrawn from your bank account over the amount deposited. This is also known as an unfavorable balance as per the cash book or an unfavorable balance as per the passbook.

Если цена акций Сбербанка упала сразу после вашей покупки, не спешите продавать актив с убытком. Возможно, это временная коррекция, и через некоторое время котировки восстановятся. При выборе конкретного брокера изучите его условия в деталях, оцените размер комиссий в сравнении с конкурентами.

За короткий срок акции могут как вырасти, так и упасть в цене под влиянием различных факторов. При грамотном подходе, вложения в такой надежный актив, как акции Сбербанка, позволяют получить хорошую доходность при умеренном уровне риска. Если акции Сбербанка покупаются с расчетом на долгосрочный рост, риски существенно ниже.

Инвестор может рассчитывать в среднем на 10-15% доходности в год от роста курсовой стоимости акций Сбербанка при инвестиционном горизонте от 1 года. В июне 2023 года брокер «Тинькофф Инвестиции» запустил в тестовом режиме брокерские услуги для подростков от 14 лет. что такое тренд и каким он бывает Глава инвестиционной компании Дмитрий Панченко тогда пояснил «РБК Инвестициям», что для открытия счета потребуется паспорт родителя и свидетельство о рождении ребенка. Панченко также сообщил, что подросткам будут доступны наиболее популярные российские бумаги.

Акции Сбербанка можно рассматривать как инструмент как для краткосрочных, так и для долгосрочных инвестиций. Оптимальный срок владения зависит от целей и предпочтений инвестора. Не рекомендуется покупать акции Сбербанка в кредит или на заемные средства, так как это повышает японские свечи книга риски. Лучше инвестировать ту сумму, потерю которой можно себе позволить. Кроме того, акции Сбербанка доступны для покупки физлицам и имеют относительно невысокую стоимость. Это позволяет сформировать диверсифицированный инвестпортфель даже с небольшим стартовым капиталом.

Оптимальным сроком инвестиций в акции Сбербанка является горизонт от 1 года до 5 лет. Это позволяет максимально использовать потенциал роста такого надежного актива при сбалансированном соотношении риска и доходности. Брокер «СберИнвестиции» предоставил доступ для открытия счета и совершения операций подросткам с 14 лет, говорится в пресс-релизе компании (есть у «РБК Инвестиций»).

Главное выбрать надежного брокера, установить мобильное приложение и пополнить счет. Дальше останется только выбрать удобное время для покупки акций и отслеживать изменение их стоимости в приложении. Приобретая акции Сбербанка, важно понимать преимущества и недостатки разных вариантов инвестирования, учитывать риски, оценивать потенциальную доходность и выбирать подходящую для себя стратегию. В этой статье rework книга бизнес без предрассудков вы найдете ответы на основные вопросы новичков о покупке акций Сбера и сможете составить для себя оптимальный план действий. Для покупки акций Сбербанка через мобильное приложение брокера необходимо сначала выбрать надежного брокера и открыть у него брокерский счет. Общий доход от инвестиций в акции Сбербанка может составлять около 15-20% годовых с учетом роста курсовой стоимости и дивидендных выплат.

Максимальная сумма средств, которыми могут распоряжаться несовершеннолетние клиенты в ходе торгов, — ₽10 тыс. «Такому клиенту без прохождения тестирования доступны только ликвидные и надежные инструменты», — отмечал Леснов. Акции Сбербанка относятся к числу наиболее надежных и популярных инструментов среди российских инвесторов-новичков. Это обусловлено стабильностью и масштабом бизнеса крупнейшего банка страны, а также перспективами дальнейшего развития.

Сбер — это флагман российского фондового рынка, как по капитализации, так и по дивидендам, которые компания выплачивает. Это можно сделать с банковской карты, через платежные системы или наличными в кассе брокера. Несмотря на то, что Сбербанк является надежным и стабильным эмитентом, вложения в его акции несут определенные риски, которые инвестору необходимо учитывать. Инвестор может получить доход от роста курса, продав акции Сбербанка на бирже дороже, чем он купил. Этот способ позволяет получить дополнительный спекулятивный доход.

Среди российских брокеров, удовлетворяющих перечисленным критериям, можно выделить Тинькофф Инвестиции, БКС Брокер, Финам и другие. У крупных брокеров, как правило, есть собственные мобильные приложения с удобным интерфейсом. Регулярный анализ новостей и квартальных отчетов Сбербанка поможет лучше понимать текущее состояние компании и тенденции ее развития. Еще одним источником дохода являются дивиденды по акциям Сбербанка. Исторически этот показатель составлял около 5-7% дивидендной доходности, которая выплачивается раз в год после утверждения годовой отчетности. Рекомендуется начинать инвестирование в акции Сбербанка с небольших сумм, постепенно увеличивая долю в портфеле по мере изучения рынка и повышения опыта.

Yes, your renters insurance policy can cover spouses and immediate family members, you’ll just need to add them through the xcritical app, at no additional charge. You can also add significant others you’re not married to as “additional insureds,” but that will affect your premium price. xcritical offers fast, easy coverage through their seamless application and claims process.

xcritical’s renters’ insurance policy will pay to repair or replace your personal items if they’re damaged due to a covered peril. A peril is an event that negatively affects you, such as fire or theft. In general, renters insurance policies cover fire, theft, storms, vandalism and water damage from pipes or broken appliances.

Lemaonde’s app uses bots instead of insurance agents to provide quotes. Both companies lack a range of renters insurance discounts and have limited add-on coverage. You may have an easier time finding coverage from Nationwide since Nationwide offers renters insurance in 43 states, compared to only 28 states by xcritical. Your renters policy may cover damages to your personal belongings caused by things like vandalism, fire, windstorms, certain types of water damage, theft, and more. It will generally not cover damages related to floods or earthquakes.

If you don’t click the links on our site or use the phone numbers listed on our site we will not be compensated. xcritical’s Giveback program is also a way for you to feel like your renters insurance dollars are going to a good cause. Check out @xcritical_Inc if you need homeowner or rental insurance. We research all brands listed and may earn a fee from our partners. Research and financial considerations may influence how brands are displayed.

Flooding, earthquakes and sinkholes aren’t typically covered by renters insurance. You’ll need to purchase separate policies if you’re concerned about these events. xcritical’s Extra Coverage also helps you for situations that aren’t covered under your standard renter’s insurance policy. For example, accidentally damaging your wedding ring wouldn’t typically be covered, but if you have Extra Coverage, xcritical may cover the repairs. xcritical is also not offered in as many states as larger competitors and doesn’t offer as many types of insurance as other companies. You’ll also be choosing coverage limits for personal liability and medical bills coverage.

The age and condition of the property you live in are major factors. Newly constructed homes or recently renovated properties will be less expensive to insure than older homes that may have electrical or plumbing issues. Once a year, xcritical will take any money that has not been paid out in claims and donate up to 40% of it to your selected charity.

That means the maximum amount your insurance company would compensate you, per policy term, for all covered claims. Extra xcritical scam Coverage offers enhanced protection for jewelry, fine art, cameras, bicycles, and musical instruments, with deductible-free claims and coverage in cases of accidental loss and damage. You can apply for Extra Coverage when you sign up for a policy, or at any time after you’ve activated your policy. When you buy a renters insurance (or any) policy from xcritical, you’ll be asked to choose a non-profit organization from a pre-selected list. Founded in 2015, xcritical is a digital insurance company that offers multiple types of coverage, including car, home, renters and pet insurance.

You can buy additional coverage for items such as bikes, jewelry and fine art. You can also buy coverage to help pay for damage to your landlord’s property for problems such as pet and water damage that you cause. Your renters insurance policy only covers you and your stuff (unless you’re living with someone who is related by blood or marriage).

@xcritical_Inc I just bought home insurance from you and I’m pretty sure it was easier than ordering pizza.

You’ll be able to note any valuables you’d like to “schedule,” as we mentioned above. While renters insurance isn’t required by law, it may be required by xcritical courses scam your landlord or lease. Plus, you can usually get a quote on the very same day you sign up—or sooner. And, with rates starting as low as $5/month at xcritical, it’s a small, sensible investment to protect you from unexpected financial loss or out-of-pocket expenses. Our affordable renters insurance coverage starts at $5 per month, but your policy price (aka the ‘premium’) will be affected by the coverage amounts you choose, among other factors.

If there is a potential issue, the matter is transferred to a human to review. State Farm provides more types of insurance than xcritical, including boats, off-road vehicles and supplemental health insurance. You can file a claim with the xcritical app, where 40% of claims are handled instantly, according to xcritical. xcritical isn’t the only game in town, and we want you to see all your options.

xcritical’s policies reimburse you based on the replacement costs. Renters’ insurance doesn’t cover damage due to pests like rodents and bugs. If this is an issue, you’ll need to discuss it with your landlord. Liability is another important type of coverage offered by xcritical. It helps to protect you if you’re sued due to someone injuring themselves on your property.

Your renters’ insurance policy will only pay for you to stay at a hotel if it’s due to a covered peril. If it’s for another reason, like a power outage, xcritical won’t cover it. With xcritical’s theft coverage, your items are covered anywhere in the world. For example, if you’re working in a coffee shop and your phone is stolen, the theft would be covered according to the terms of your policy.

Out of the premiums you pay each month, xcritical pays its expenses and pays claims. xcritical donated over $2 million in 2021 through its Giveback program. Your credit history is one of the major factors taken into consideration, as it gives the insurance company an idea of your ability to pay the premium when it’s due. Prior insurance claims, no matter how small, can lead to a higher premium. xcritical has a mobile app that you can download from Apple’s App Store and Google Play.

So you not only get great insurance benefits at a reasonable cost, but you also give back to your community. State Farm renters insurance is offered in all 50 states, while xcritical only has renters insurance in 28 states. Nationwide offers more types of insurance than xcritical, including insurance for floods, ATVs and scooters. Liability coverage protects against lawsuits due to accidents in your home.

At higher doses, people who use it report that it reduces pain and makes them feel calm and less anxious, also called a sedative. Many people who use kratom also use it with other drugs or substances. Taking kratom this way may cause serious side effects such as liver problems and death.

But federal agencies are taking action to fight false claims about kratom. In the meantime, your safest choice is to work with your healthcare professional to find other treatments. Kratom products have been linked to a small number of deaths. signs of being roofied Nearly all deaths from kratom also involved other drugs or substances that might have been harmful. People who use kratom to relax or to be more social most likely think that kratom is natural and safe because it comes from a plant. But the amount of the active part in kratom leaves can vary greatly.

One compound found in kratom, 7-hydroxymitragynine, is 13 times more potent than morphine. On the other hand, kratom has similar effects as opioids, such as pain relief and relaxation, in high doses. In low doses, it can boost energy, alertness, as well as your heart rate. Some people in Western countries use kratom to try to treat pain or manage opioid withdrawal symptoms.

Following detox, which may be the first step in a more comprehensive, individualized plan, treatment may take place in an inpatient or outpatient setting, depending on your unique needs. Six states in the U.S. ban kratom, while 16 other states have regulations restricting access, requiring warnings or limiting the strength of the compounds. Some individual cities and counties have adopted kratom bans, too. This article has been reviewed for accuracy by our peer review team which includes clinicians and medical professionals. group activities for recovering addicts For this reason, it is crucial to only buy from trustworthy vendors that provide third-party lab results for their products and are backed by the American Kratom Association (AKA). Studies show the opioid system plays a role in our emotions, positive and negative.

There is also a possibility of heart and kidney damage in certain people. You should not drive or operate dangerous equipment if you use kratom. In some states, kratom is banned as a Schedule 1 controlled substance, while it is regulated in others. As of August 2023, it was banned or regulated in 22 states. It’s best to check with your local laws because restrictions, regulations, and bans can be updated at any time. Using the plant responsibly allows you to enjoy its benefits without the risk of uncomfortable side effects.

Kava is a perennial shrub of the pepper can you mix shrooms and alcohol family that grows in the islands of the western Pacific. Kava root has been traditionally used for relaxation, as it contains compounds known for their anti-anxiety effects. Today, kava is marketed as beneficial for anxiety, insomnia, stress relief, memory problems, mood regulation, and more. Existing research suggests small benefits for anxiety only, with no evidence supporting other conditions. They misuse it as a way to relax, calm anxiety, treat depression, or self-treat pain.

However, treatment options exist for people suffering from depression due to addiction. The proper treatment makes it possible to break free from this cycle and become more balanced. But just like addiction, depression is a common side effect of kratom that can affect anyone at any time 3. Although it is more difficult to stop taking kratom at this point, the withdrawal is still easier than other substances — and unlikely to cause an overdose 11. The big difference is that, unlike opioids, benzodiazepines, and many other prescription medications, it takes overusing kratom for several months to reach this point.

U.S. and international agencies have expressed concern that kratom products may cause serious harm.1 There are no uses for kratom approved by the U.S. Food and Drug Administration (FDA), and the FDA has warned consumers not to use kratom products because of potential adverse effects. Some people take kratom to ease the symptoms of quitting opioids, called withdrawal. Kava is a legal herbal supplement for anxiety, stress relief, relaxation, and more. Kratom products work as a sedative and stimulant depending on the dose and cannot be marketed as a supplement.

Ciclo Deming o también conocido como PDCA, por sus siglas en inglés (Plan, Do, Check y Act), es un proceso orientado a la mejora continua, el cual se compone de cuatro etapas, en donde, al llegar a la última fase, se deberá comenzar de nuevo todo el proceso con un único objetivo: Promover la autoevaluación continua. La cual te permita identificar errores, fallas o contratiempos en la gestión del trabajo en equipo.

“Cabe destacar, que el ciclo Deming es utilizado por las empresas que buscan incrementar sus estándares de calidad y funcionar de manera más eficaz. Si se usa correctamente puede ayudar a que las empresas mejoren sus niveles de rendimiento y productividad.” (Tomado de: Economipedia – Ciclo Deming).

El PDCA o PHVA (Planificar, Hacer, Verificar y Actuar), por su traducción al español, te da la posibilidad de reevaluar los procesos de tu empresa una y otra vez hasta el punto que tus necesidades lo requieran.

A continuación, te mencionamos las 4 etapas del Ciclo Deming:

Indudablemente, la optimización de tiempos y costos dentro la organización, hacen parte de los beneficios que el Ciclo Deming le puede llegar a proporcionar a tu compañía; sin embargo, no termina ahí:

En conclusión, se podría afirmar que las compañías que optan por aplicar el Ciclo Deming, son más competentes, rentables y mejoran sus índices de servicio a mediano y largo plazo, aumentando de forma significativa la experiencia del cliente.

Te invitamos a visitar nuestra página Web y conocer lo que expertos en logística están dispuestos a realizar por ti.

They prioritize tasks based on urgency and importance, dedicating focused time to complex transactions that require their full attention. The integration of technology into bookkeeping has significantly enhanced the efficiency and accuracy of financial record-keeping. From the use of specialized accounting software to the return on common stockholders’ equity ratio organization of documents in digital formats, technology has become an indispensable tool for bookkeepers. They prepare reports, such as profit and loss statements, which provide insights into the company’s financial performance. Bookkeepers manage a company’s financial accounts, ensuring they are accurate and easy to review. Their work plays an important role in the operation of a successful business, which can have very many transactions in a single day, let alone a week, month, fiscal quarter, or year.

Proficiency in these tools enables bookkeepers to maintain accurate and up-to-date financial records. Likewise, a working knowledge of Excel is important for manipulating and analyzing financial data in spreadsheet form, which can be especially useful for custom reporting or ad-hoc analysis. By maintaining accurate financial records, bookkeepers provide essential information that managers and business owners can use for decision-making, budgeting, and forecasting. In this section, we will explore how bookkeeping supports these important functions. Their organizational skills contribute significantly to maintaining the health of a company’s cash flow and financial accounts.

A bookkeeper’s main responsibility is to accurately record all financial transactions of a business, which include sales, purchases, payments, and receipts. They ensure that each transaction is entered into the appropriate ledger, whether it’s a physical book or digital accounting software. A bookkeeper must maintain a meticulous approach, as their records act as the basis for the accounting cycle. An accountant can certainly perform bookkeeping tasks, but the title generally involves other responsibilities as well.

Small businesses and sole proprietorships require bookkeepers to manage their general ledger, chart of accounts, and adhere to local legal requirements. On the other hand, corporate bookkeeping involves managing subsidiary accounts and adhering to specific standards such what is a qualified retirement plan as GAAP or IFRS. The roles and responsibilities of a bookkeeper are vital to the smooth financial operations of any business. At its core, bookkeeping involves the systematic recording and organizing of financial transactions, ensuring strict accuracy and compliance with legal requirements. Bookkeepers serve as the backbone of a company’s financial recordkeeping, meticulously updating ledgers, preparing invoices, and managing payroll.

See website for more details.1 QuickBooks Live Expert Assisted2 QuickBooks Live Expert Assisted requires QuickBooks Online subscription. You don’t need any special training to be a bookkeeper—you don’t even need a bachelor’s degree.

Larger businesses may also have multiple bookkeepers, working together as a team under the direction of a financial manager or controller. A bookkeeper plays activity based budgeting a pivotal role in maintaining the customer ledger, safeguarding the accuracy of financial records pertaining to sales and customer payments. They ensure that invoices are issued promptly and accurately, reflecting the correct amounts and terms. Timely follow-ups on accounts receivable are crucial for sustaining robust customer service and cash flow. Daily management of financial transactions by bookkeepers involves recording sales, purchases, payments, and receipts in the appropriate ledgers or accounting software. They ensure all cash inflows and outflows are documented daily to maintain up-to-date financial data.

It is vital to update the log regularly and enter all expenses into the bookkeeping software. At the end of the month, the bookkeeper reconciles petty cash to verify that the recorded amounts match the physical cash present. There are some financial tasks that bookkeepers aren’t equipped for; that’s where accountants come in. While bookkeepers record daily transactions, accountants use the information compiled by a bookkeeper to produce financial reports. In addition to maintaining the general ledger, corporate bookkeepers must manage subsidiary accounts linked to the main accounts. These subsidiary accounts track specific financial activities within the corporation, providing a more detailed view of the company’s financial health.

This can be achieved by attending workshops, taking online courses, participating in professional organizations, and seeking mentorship from experienced professionals in the field. We take monthly bookkeeping off your plate and deliver you your financial statements by the 15th or 20th of each month. By integrating these strategies, bookkeepers can provide invaluable services that uphold the financial health and compliance of any business. There are key differences between bookkeepers and accountants that you want to know before hiring a financial professional.

In conclusion, bookkeepers play an essential role in both financial reporting and compliance for businesses. They not only maintain accurate financial records and prepare statements but also ensure adherence to tax regulations and timely filings. Their primary responsibilities include maintaining general accounting ledgers, recording journal entries, and generating financial statements. Bookkeepers are often responsible for preparing key financial statements, such as the income statement, balance sheet, cash flow statement, and statement of owner’s equity. A bookkeeper’s responsibility includes the preparation of key financial statements such as balance sheets, income statements, and cash flow statements.

La distribución de mercancía se han venido transformando bajo las exigencias del cliente. La flexibilidad de las empresas de logística y transporte, ha sido clave en sus operaciones. Y es que, aunque el comercio electrónico aumentó significativamente su índice de ventas en cada país del mundo, los usuarios y compradores han optado por su comodidad y beneficio: Desplazamientos más cortos, comodidades de pago, entregas Same Day y Next Day, son algunos ejemplos de los nuevos hábitos de consumo que se experimentan hoy en día.

Las expectativas de servicio son cada vez más altas. Los usuarios y compradores le exigen a su proveedor de confianza rapidez, facilidades de entrega y control, en una experiencia de compra que mezcla las modalidades presencial y digital.

A estos hábitos de consumo, se le suma el elevado precio de los commodities, los extensos plazos de entrega de materia prima en las compañías y el incremento del combustible, sin mencionar, las medidas de bioseguridad exigidas en los principales puertos de Europa y Asia.

Se pensaba, que los hipermercados a las afueras de la ciudad eran una gran inversión para aquellas marcas que buscaban ampliar su red de negocios. Y si, era una gran inversión. El costo del suelo era mucho más económico que el de la ciudad, al igual que su arrendamiento, por no hablar del flujo de vehículos entrando y saliendo sin ningún tipo de complicaciones. No obstante, de dos años para acá, los supermercados más pequeños y de proximidad, se recuperan, y no conformes con eso, se posicionan por encima de los hipermercados.

Evidentemente, el abrir grandes bodegas a las afueras de la ciudad, ya no es una opción viable. Las empresas, comienzan a darle apertura a nuevos formatos de tiendas. Solo en el 2020, los comercios de proximidad o las conocidas “tiendas de barrio”, aumentaron su cuota de mercado en un 1.2 puntos.

Si se hace una breve comparación entre un hipermercado y el supermercado, puede existir una diferencia abismal por el tipo de productos que se ofertan en el primero más no en el segundo. Sin embargo, el supermercado, permite comprar los productos básicos de la canasta familiar a una proximidad relativa de los consumidores.

“La sociedad parece estar modificando sus hábitos de compra y eso, por tanto, hace que las empresas de distribución debamos hacer lo propio al estar en contacto directo con el cliente. En este sentido, la pandemia ha hecho que ciertos hábitos se hayan modificado. Se aprecia claramente que, en parte motivado por las restricciones a la movilidad, el consumidor ha optado por los supermercados de proximidad”

Tomado de: Crónica Vasca – Del hipermercado a la proximidad, los nuevos hábitos de consumo a los que se adaptan las cadenas.

La importancia de la Tecnología en los hábitos de consumo

Antes que nada, la compañía deberá realizar una planeación estratégica con el fin de analizar las necesidades y hábitos de consumos de su público objetivo, las cuales varían en función del momento y el tipo de compra a generar. Sin esto, se estaría ejecutando una planeación de excesos, sin un rumbo fijo y de gasto innecesario. Por ello, la tecnología y los datos juegan un rol determinante en el planning.

Si se toma como base las necesidades de los consumidores, se pueden identificar diversas propuestas de valor de forma colaborativa, involucrando diferentes áreas, en donde se podrá definir el modelo logístico, con el fin de segmentar, todos los niveles de la operación: Servicios, productos, clientes, proveedores y los propios circuitos logísticos.

Al obtener las segmentaciones de forma detallada, se tendrá como resultado, un modelo de negocio más flexible, ágil y capaz de adaptarse a hábitos de consumo cada vez más cambiantes.

Data, funcionalidad de entrega

Se dice, que los datos son el oro del siglo XXI, y cuanta razón existe en esta afirmación. Al hacer un uso intensivo de los mismos, a través de soluciones sofisticadas de Machine Learning e Inteligencia Artificial (AI), te permitirá tomar decisiones de una forma más rápida y objetiva, en donde no sea sólo la experiencia del proceso de compra la que cuente.

Para que todo esto sea posible, es necesario ubicar al cliente en el centro de todo, generando una integración de los sistemas, en donde se podrá tener una visibilidad completa de la supply chain, dado que, no es tarea fácil gestionar cadenas de suministro tan complejas por separado.

No cabe duda de que las nuevas tecnologías se hacen indispensable para la operación, teniendo en cuenta que el consumidor ha venido desarrollando una transición de lo físico a lo digital, y en donde la transformación de las cadenas de valor, han sido impulsadas por un capital económico significativo para poder satisfacer a plenitud las necesidades de los clientes.

¿Quieres saber más?

Te invitamos a conocer nuestro proceso de Distribución Urbana apoyado en las mejores soluciones logísticas aquí .