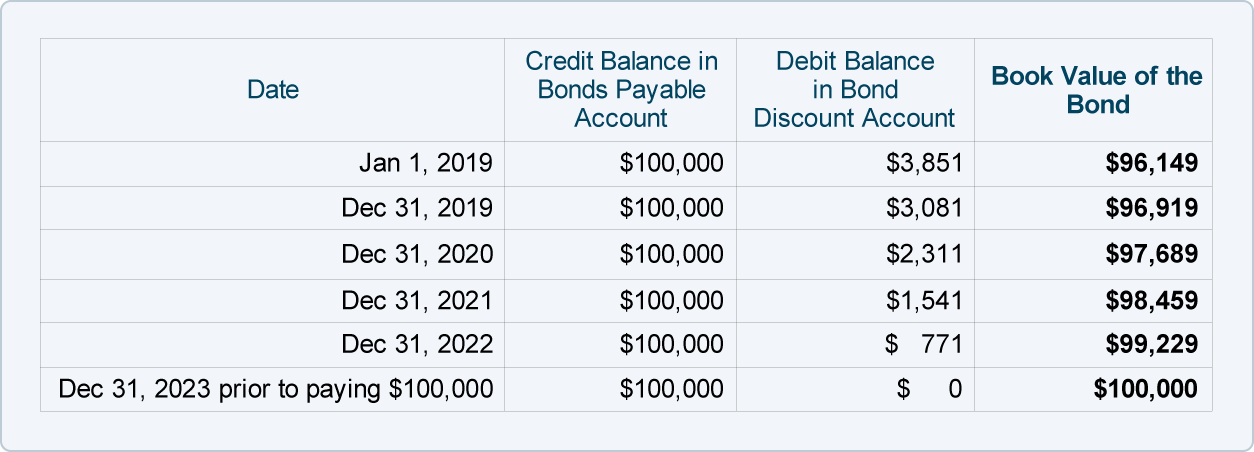

As a result, you’ll need to deduct the amount of these checks from the balance. Such information is not available to your business immediately, so you record no entry in the business’ cash book for the above items. You will know about this only when you receive the bank statement at the end of the month. As a result, your balance as per the passbook would be less than the balance as per the cash book. In this instance, your bank has recorded the receipts in your business account at the bank, while you haven’t recorded this transaction in your cash book.

Omission error

You have to go back and compare your records with the bank’s to try and figure out what went wrong so you can correct your records to match the banks. To quickly identify and address errors, reconciling bank statements should be done by companies or individuals at least monthly. They also can be done as frequently as statements are generated, such as daily or weekly. Non-sufficient funds (NSF) checks are recorded as an adjusted book-balance line item on the bank reconciliation statement. One reason for this is that your bank may have service charges or bank fees for things like too many withdrawals or overdrafts. Or there may be a delay when transferring money from one account to another.

Bank reconciliation statements compare transactions from financial records with those on a bank statement. Where there are discrepancies, companies can identify and correct the source what is supply chain finance scf guide of errors. One of the most common causes of discrepancies in bank reconciliations is delays in deposit and transaction processing. Checks sent or received at the end of the day, or toward the end of the month, may be subject to delay which will prevent them from being included on the bank statement. Accounting for these delays is key to reconciling the total amounts on the company’s financial statement and the bank statement. Begin with a side-by-side comparison of your bank account statement and your company’s accounting records.

Our Services

However, businesses with a high transaction volume or increased fraud risk may need to reconcile more frequently, sometimes even daily. The key is to establish a routine that best suits your business’s unique needs and financial activity. A bank reconciliation statement is a document prepared by a company that shows its recorded bank account balance matches the balance the bank lists.

Step 2: Review the deposits and withdrawals

- The items therein should be compared to the new bank statement to check if these have since been cleared.

- Instead of doing a bank reconciliation manually and risking oversight, you need expense management software to ensure efficiency and accuracy.

- The debit balance as per the cash book refers to the deposits held in the bank, and is the credit balance as per the passbook.

- This reconciliation of the company records is done in another additional column added, which is then available for further adjustments.

(f) The cash book does not contain a record of bank charges, $70, raised on 31 May. (c) A deposit of $5,000 received by the bank (and entered in the bank statement) on 28 May does not appear in the cash book. This is an important fact because it brings out the status of the bank reconciliation statement.

Common errors and how to avoid them

If you haven’t been using bank reconciliation statements, now is the best time to start. The frequency of bank reconciliation can vary based on your company’s specific needs. Some businesses balance their invoice number bank accounts monthly, after receiving their monthly bank statements.

These fees are charged to your account directly, and reduce the reflected bank balance in your bank statement. These charges won’t be recorded by your business until your bank provides you with the bank statement at the end of every month. A bank reconciliation statement making payments late payments and filing extensions is only a statement prepared to stay abreast with the bank statement; it is not in itself an accounting record, nor is it part of the double entry system. This will ensure your unreconciled bank statements don’t pile up into an intimidating, time-consuming task. When you do a bank reconciliation, you first find the bank transactions that are responsible for your books and your bank account being out of sync.

Doing a bank reconciliation is fairly simple, but you need to be diligent in your efforts and avoid skipping steps to ensure the right checks and balances. After adjusting the balance as per the cash book, you’ll need record all adjustments in your company’s general ledger accounts. Preparing a bank reconciliation statement is done by taking into account all transactions that have occurred up until the date preceding the day the bank reconciliation statement is prepared. To reconcile your bank statement with your cash book, you’ll need to ensure that the cash book is complete and make sure that the current month’s bank statement has also been obtained. Whereas, credit balance as the cash book indicates an overdraft or the excess amount withdrawn from your bank account over the amount deposited. This is also known as an unfavorable balance as per the cash book or an unfavorable balance as per the passbook.