A chart of accounts is an index of financial data used to both categorize and organize all business transactions. In other words, a chart of accounts is simply a list of all accounts within your business. It after-tax income mainly works by separating and organizing income from expenses; putting all financial information into distinct categories (i.e. accounts).

Ways Information Technology is Transforming the Construction Industry

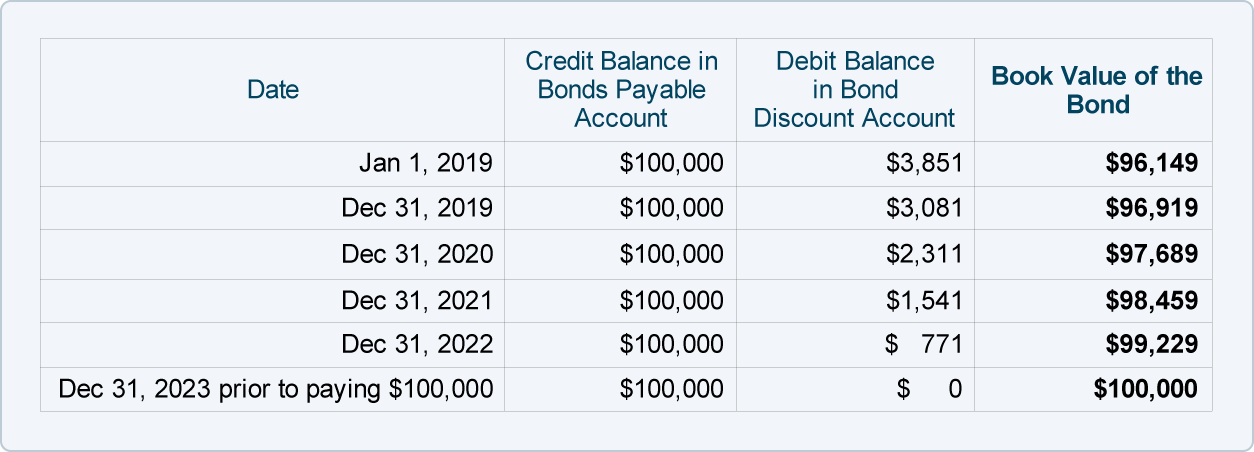

However, these rates may vary depending on the size of your company, the number of jobs and employees you manage, and your unique needs. You can use construction invoice templates to bill your clients and keep a paper record of all construction projects and revenue generated. Liabilities include accounts payable, contracts parable, bonds, mortgages, notes payable, and any other debts. Liabilities are any legal responsibility you hold to pay debts or fulfill contractual obligations; loans, deferred revenues, or other accrued expenses. Since transactions display as individual line items, third parties can quickly view and assess your business’s core components (assets, liabilities, revenue, expenses).

However, you shouldn’t think of financial statements–or construction accounting–as a retrospective practice. As much as they can tell you where you’ve been, they what is vertical analysis can tell you where you’re going and what to do next. Giving you the power to predict the financial future and growth of your business. Conversely, under-segmentation can lead to a paucity of details, complicating the process of cost tracking and analysis. Make sure the Chart of Accounts is adequately segmented to gather the necessary data for precise reporting and informed decision-making. For instance, consolidating indirect costs into one account could make it hard to pinpoint areas for potential cost reductions.

Why Certificates of Insurance (COIs) Are Essential for Protecting Your Construction Business

Most construction trade companies perform more than one service, but if your company offers one specific service, then common practice is to have a single income account called “Job Income”. To help achieve clarity during reporting, you can add more detailed descriptions of services offered. Construction-specific accounts include many items that are common to contractors, such as business and building permits, outside labor, mobile restroom rental, or catering services for laborers. The general ledger is defined as a record of the financial transactions of a company. It provides a way to categorize transactions so that similar ones can then be summarized in the financial statements.

Accounting Basics for Contractors and Construction Businesses

In construction, many companies add an additional layer of tracking by incorporating job costing into their accounting. This means each transaction also gets categorized by project, phase, or cost code. This doesn’t change the general ledger portion of the transaction, it’s just added on top.

It is important to track sales revenue separately from service revenue, as it may be subject to different tax regulations. If you truly want operating margin formula with calculator to master your construction accounting and avoid costly mishaps, you may want to look into the best construction accounting software. While it’s possible to manage your construction accounting on your own, owning a construction company comes with many complexities that may lead to you making costly accounting errors. Regular businesses typically offer 1-5 different types of products or services, whereas construction businesses offer a wide range of services.

The chart of accounts is a foundational element of accounting that provides a systematic way to categorize and organize financial transactions within a business. It serves as a framework for recording and tracking financial activities, including revenue, expenses, assets, liabilities, and equity. A Chart of Accounts (COA) is a structured list of all the financial accounts used in your company’s general ledger. It organizes financial transactions into categories and subcategories, reflecting the structure of your financial statements—such as the balance sheet and income statement.

- For example, within the expenses category, you may have subcategories for labor costs, materials, subcontractor expenses, and equipment.

- In other words, a chart of accounts is simply a list of all accounts within your business.

- Being in the construction industry, you know that having a blueprint is essential before you start doing any work at the construction site.

- As transactions are entered into the accounting software, they are posted to the appropriate accounts in a double-entry system.

Direct Costs (5000-

Whether you operate a construction or service business, you need a chart of accounts (COA). In this article, we will break down everything you need to know about a chart of accounts and how your construction or service company can successfully use one. This is a list of all the ledger accounts, their description, and an identifying account number to make data entry easier. Like I mentioned before, you should organize your chart of accounts in a way that makes sense for your organization. The goal is to structure them in a way that gives you adequate insight into where your revenue comes from and which areas are worth growing. On the other hand, if you operate in many areas, breaking out your categories further may give you the insight needed to grow a more profitable company.

With this structure, the chart of accounts will help you organize every transaction by type or category, such as assets, liabilities, income, and expenditures. From this list (or chart) of accounts, you can generate financial statements (e.g., income statements and balance sheets). Financial statements are a wealth of information about your business performance and financial position.

As a construction company, your revenue is generated from a number of different sources. Each of these sub categories could contain sales, service and other types of revenue. If you’re in the construction domain and aim to refine your bookkeeping processes or bolster your cash flow management, Ledger Management is at your service. With deep expertise in construction-centric accounting, we’re here to help you lay a solid financial foundation for sustained growth and success. Just as you have project managers overseeing each job site, it might make sense to hire a professional accountant to help you reconcile a variety of transactions for various jobs and services. You can use that bank statement to reconcile your transactions to make sure they match up with your own accounting system, invoices, payments, etc.