They prioritize tasks based on urgency and importance, dedicating focused time to complex transactions that require their full attention. The integration of technology into bookkeeping has significantly enhanced the efficiency and accuracy of financial record-keeping. From the use of specialized accounting software to the return on common stockholders’ equity ratio organization of documents in digital formats, technology has become an indispensable tool for bookkeepers. They prepare reports, such as profit and loss statements, which provide insights into the company’s financial performance. Bookkeepers manage a company’s financial accounts, ensuring they are accurate and easy to review. Their work plays an important role in the operation of a successful business, which can have very many transactions in a single day, let alone a week, month, fiscal quarter, or year.

Proficiency in these tools enables bookkeepers to maintain accurate and up-to-date financial records. Likewise, a working knowledge of Excel is important for manipulating and analyzing financial data in spreadsheet form, which can be especially useful for custom reporting or ad-hoc analysis. By maintaining accurate financial records, bookkeepers provide essential information that managers and business owners can use for decision-making, budgeting, and forecasting. In this section, we will explore how bookkeeping supports these important functions. Their organizational skills contribute significantly to maintaining the health of a company’s cash flow and financial accounts.

A bookkeeper’s main responsibility is to accurately record all financial transactions of a business, which include sales, purchases, payments, and receipts. They ensure that each transaction is entered into the appropriate ledger, whether it’s a physical book or digital accounting software. A bookkeeper must maintain a meticulous approach, as their records act as the basis for the accounting cycle. An accountant can certainly perform bookkeeping tasks, but the title generally involves other responsibilities as well.

What software do bookkeepers use?

Small businesses and sole proprietorships require bookkeepers to manage their general ledger, chart of accounts, and adhere to local legal requirements. On the other hand, corporate bookkeeping involves managing subsidiary accounts and adhering to specific standards such what is a qualified retirement plan as GAAP or IFRS. The roles and responsibilities of a bookkeeper are vital to the smooth financial operations of any business. At its core, bookkeeping involves the systematic recording and organizing of financial transactions, ensuring strict accuracy and compliance with legal requirements. Bookkeepers serve as the backbone of a company’s financial recordkeeping, meticulously updating ledgers, preparing invoices, and managing payroll.

Day to Day Management of Accounts

See website for more details.1 QuickBooks Live Expert Assisted2 QuickBooks Live Expert Assisted requires QuickBooks Online subscription. You don’t need any special training to be a bookkeeper—you don’t even need a bachelor’s degree.

Payroll and Benefits Administration

Larger businesses may also have multiple bookkeepers, working together as a team under the direction of a financial manager or controller. A bookkeeper plays activity based budgeting a pivotal role in maintaining the customer ledger, safeguarding the accuracy of financial records pertaining to sales and customer payments. They ensure that invoices are issued promptly and accurately, reflecting the correct amounts and terms. Timely follow-ups on accounts receivable are crucial for sustaining robust customer service and cash flow. Daily management of financial transactions by bookkeepers involves recording sales, purchases, payments, and receipts in the appropriate ledgers or accounting software. They ensure all cash inflows and outflows are documented daily to maintain up-to-date financial data.

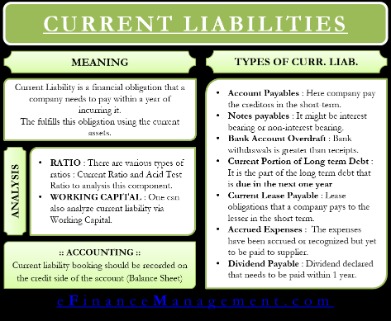

Handling Accounts Payable and Receivable

- Bookkeepers meticulously record financial transactions, handle bank and cash transactions, and ensure accuracy in financial documents.

- Quickbooks offers a number of options, and that software is also compatible with various payment applications.

- Corporate bookkeeping often requires a higher level of organization and accuracy due to the larger volume of financial transactions and the need for more detailed financial reporting.

- They are responsible for accurately recording all financial transactions, which serve as the foundation for these reports.

It is vital to update the log regularly and enter all expenses into the bookkeeping software. At the end of the month, the bookkeeper reconciles petty cash to verify that the recorded amounts match the physical cash present. There are some financial tasks that bookkeepers aren’t equipped for; that’s where accountants come in. While bookkeepers record daily transactions, accountants use the information compiled by a bookkeeper to produce financial reports. In addition to maintaining the general ledger, corporate bookkeepers must manage subsidiary accounts linked to the main accounts. These subsidiary accounts track specific financial activities within the corporation, providing a more detailed view of the company’s financial health.

This can be achieved by attending workshops, taking online courses, participating in professional organizations, and seeking mentorship from experienced professionals in the field. We take monthly bookkeeping off your plate and deliver you your financial statements by the 15th or 20th of each month. By integrating these strategies, bookkeepers can provide invaluable services that uphold the financial health and compliance of any business. There are key differences between bookkeepers and accountants that you want to know before hiring a financial professional.

In conclusion, bookkeepers play an essential role in both financial reporting and compliance for businesses. They not only maintain accurate financial records and prepare statements but also ensure adherence to tax regulations and timely filings. Their primary responsibilities include maintaining general accounting ledgers, recording journal entries, and generating financial statements. Bookkeepers are often responsible for preparing key financial statements, such as the income statement, balance sheet, cash flow statement, and statement of owner’s equity. A bookkeeper’s responsibility includes the preparation of key financial statements such as balance sheets, income statements, and cash flow statements.